RBC RESP Saving For My Child’s Future #SaveWithRBC

My son was only two months old when I first opened his RBC RESP account. It was one of the first things I got done once we got him home from the month long hospital stay in the NICU. I’m not going to lie, I was confused about it all but knew it was important for his future.

I don’t have a post-secondary education, and in my experience it held me back from getting jobs (even jobs I had experience in). If that’s a problem today, I couldn’t imagine what it will be like when my son starts searching the job market. There are many uncertainties about the future (where is he going to school? What will he work towards? How long will the schooling last for?) but there are two things I’m sure of:

- I want my son to have a college education

- Post secondary is costly.

I want to be prepared for the future so that’s what drove me to make the call. I want to give him as much of a step up in education as possible (although, I still expect him to work for it and work while at school – but that’s another post) I was able to open an account on the phone, but I wanted to go in person to have a few things explained.

Every little bit helps.

In my appointment I found out just how easy it was going to be to save for my son’s education. Not just because I started early but because I signed up for RESP-matic (I automatically have a set sum taken out of my bank account every month).

I also learned the best news of all: I get free money!

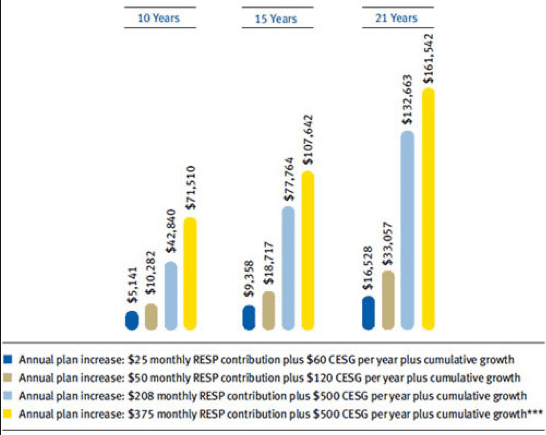

The Canada Education Savings Grant will match up to 20% for the first $2,500 contributed annually. Think about that for a second, that’s $500 annually (maxing out to the lifetime amount of $7200). $7200 is a lot of money, and will help out a lot.

So what if your child doesn’t go to post secondary or the course they take only costs a fraction of the cost? The balance of your savings are eligible to be transferred over to your RRSP (another win).

Just $25 a month can make a world of difference, just check out the chart to the left. Your investment advisor will also go through your options on high/medium and low risk options as well. You are in control of your money, savings and future.

Want more information? Check out these resources from RBC: Rbc.com/education & http://www.rbcroyalbank.com/resp/index.html

Disclosure: I am part of the RBC RESP blogger program with Mom Central Canada and I receive special perks as part of my affiliation with this group. The opinions on this blog are my own.